Understanding Our Expert Advisor Pricing & Choosing the Right EA for You

August 1, 2025

Understanding Our Expert Advisor Pricing & Choosing the Right EA for You

Many traders ask two common questions:

- Why is every Premium Expert Advisor (EA) priced at $1,500 while every Elite EA is $5,000?

- How do I select the EA that best matches my trading style and risk profile?

This guide explains our fixed-price model, the research behind each EA tier, and a step-by-step framework for choosing the best algorithmic trading tool.

1 | Transparent, Fixed Pricing

TierPricePrimary Value DriversPremium EA | $1,500 | Market-tested strategies, rigorous historical back-testing, built-in risk controls, ongoing updates.

Elite EA | $5,000 | AI & machine-learning models, dynamic adaptation to volatility regimes, multi-asset logic, institutional-grade infrastructure.

Why a fixed price?

- Fairness – Every trader pays the same amount for an EA of a given tier.

- Clarity – No flash sales, coupon codes, or hidden “extras.”

- R&D sustainability – Pricing reflects years of quantitative research, code maintenance, and live-market validation.

2 | What Defines a Premium EA?

- Proven Edge – Each strategy is stress-tested on 10 + years of tick data.

- Robust Risk Management – Fixed fractional position sizing, hard stop-loss levels, equity guards.

- Market Coverage – Optimised for major forex pairs and popular CFDs.

- Plug-and-Play – Minimal parameter tweaking; ideal for traders new to Expert Advisors.

3 | What Makes an EA “Elite”?

- AI-Powered Logic – Machine-learning algorithms that recalibrate entry and exit thresholds in real time.

- Adaptive Volatility Filters – Automatically widens or tightens stops, targets, and lot sizes as market regimes shift.

- Cross-Asset Capability – Equities, indices, crypto, and XAUUSD in a single code base.

- Advanced Infrastructure – Low-latency order routing and self-diagnostic error handling.

- Detailed Analytics – Built-in dashboards for KPI tracking (expectancy, Sharpe ratio, tail risk).

4 | Choosing the Right EA: A Three-Step Process

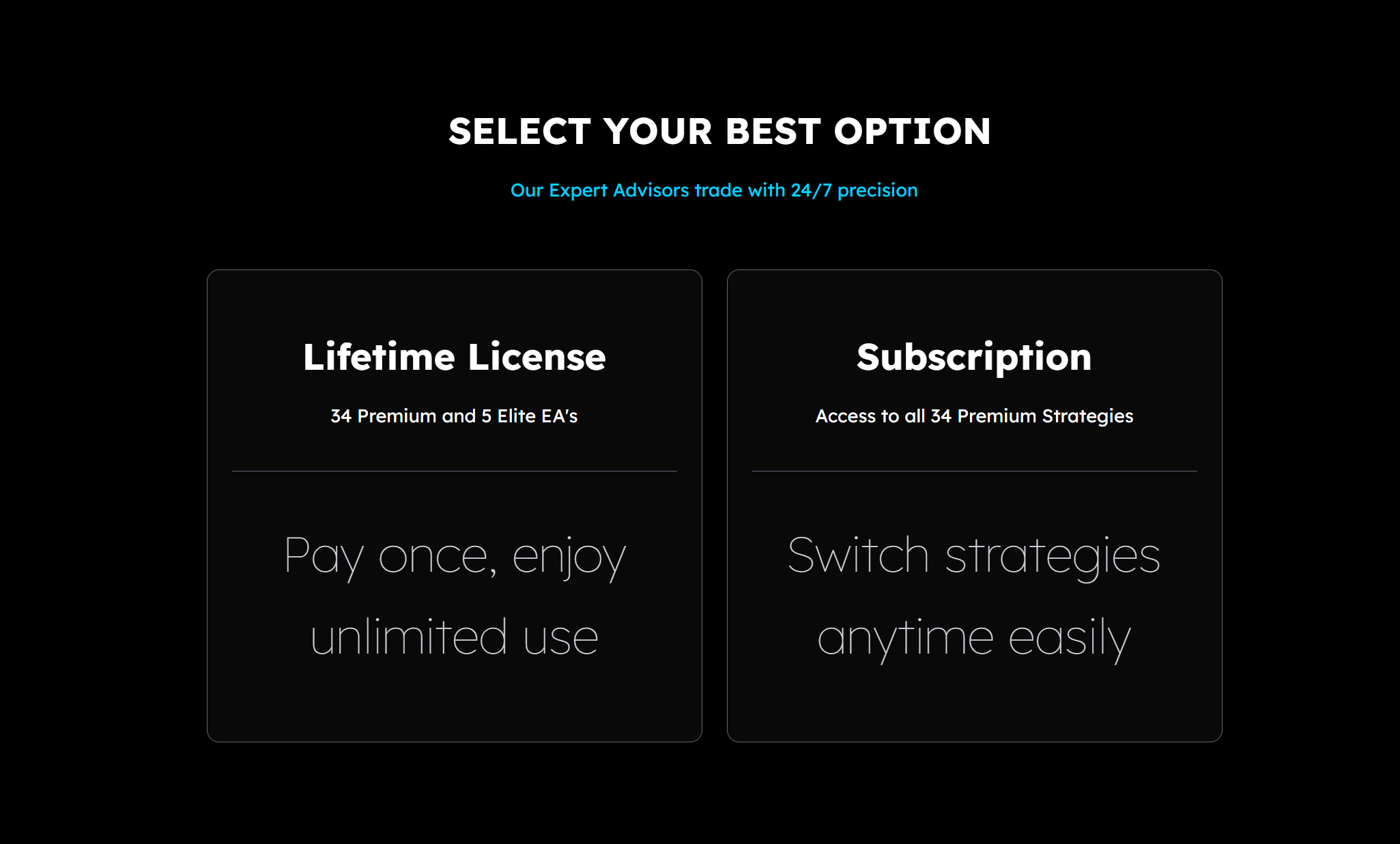

Step 1 – Start with the 12-Month Subscription

Access all Premium EAs for a full year:

- Test strategies on demo and live micro-accounts.

- Compare performance across different timeframes and market conditions.

- Identify which risk profile—scalping, swing, or news breakout—fits your goals.

Step 2 – Analyse Your Metrics

Monitor key statistics:

MetricTarget RangeWin Rate | 50 – 70 % (strategy dependent)

Maximum Drawdown | ≤ 20 % of starting equity

Profit Factor | ≥ 1.5

Sharpe Ratio | ≥ 2.0

Use these data points—not emotions—to shortlist EAs.

Step 3 – Purchase the Best Fit

Once you find the EA that aligns with your objectives and risk tolerance, buy the individual licence. Many clients recoup the one-time cost in a single profitable quarter.

Note: Elite EAs are not included in the subscription. They require more advanced configuration and are intended for traders who have already mastered Premium systems.

5 | Why We Don’t Offer Discounts

- Quality over Quantity – Each EA reflects thousands of development hours.

- Stable Pricing – Eliminates pressure to “buy before the sale ends,” ensuring thoughtful decisions.

- Lifetime Support – Revenue funds continuous optimisation, customer service, and platform updates.

6 | Need Personalised Guidance?

Our quant team can:

- Review your trading goals and risk limits.

- Recommend specific strategies (scalping, trend-following, news trading EAs, etc.).

- Provide walk-throughs on installing and optimising EAs in MetaTrader 5.

Contact us via live chat or email for a free consultation.

Ready to Begin?

- Explore the 12-Month Subscription – unlimited access to 30 + Premium EAs.

- Browse the Full EA Catalogue – detailed stats, equity curves, and back-test reports.

- Book a Strategy Session – get expert advice on algorithmic risk management.

Whatever your trading journey, fxbotexperts.com is committed to delivering transparent pricing, institutional-grade research, and tools that empower you to trade with data-driven confidence.

Disclaimer: Algorithmic trading involves risk. Past performance does not guarantee future results. Always test strategies in a demo environment before committing capital.